All Categories

Featured

State Farm agents sell whatever from property owners to auto, life, and various other popular insurance coverage products. So it's very easy for agents to bundle solutions for price cuts and simple strategy administration. Many consumers enjoy having one relied on agent take care of all their insurance policy needs. State Farm offers global, survivorship, and joint global life insurance policy plans.

State Ranch life insurance is normally conservative, supplying steady alternatives for the typical American family members. If you're looking for the wealth-building opportunities of global life, State Farm lacks affordable alternatives.

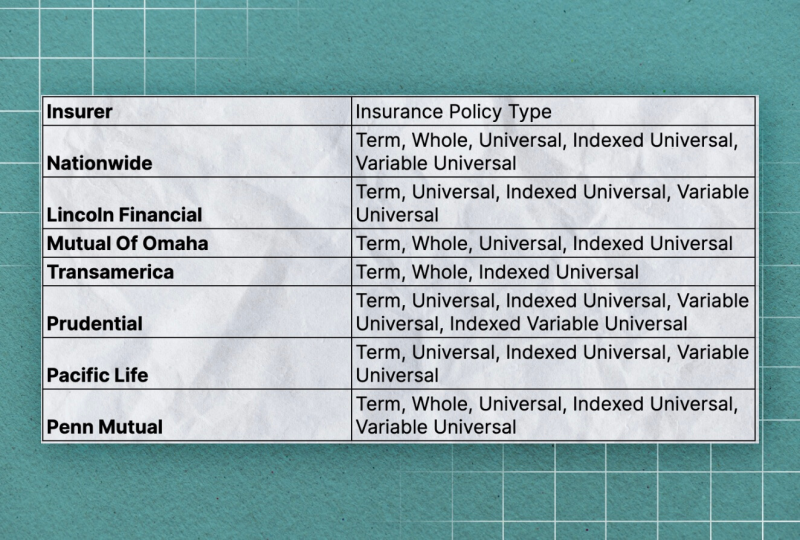

It doesn't have a strong existence in other economic products (like global strategies that open up the door for wealth-building). Still, Nationwide life insurance policy strategies are highly accessible to American households. The application procedure can also be a lot more manageable. It helps interested celebrations obtain their foot in the door with a dependable life insurance policy plan without the far more complicated conversations concerning financial investments, economic indices, and so on.

Also if the worst happens and you can't get a larger plan, having the protection of a Nationwide life insurance policy might transform a purchaser's end-of-life experience. Insurance business use medical examinations to evaluate your threat course when using for life insurance coverage.

Buyers have the alternative to transform rates each month based on life situations. A MassMutual life insurance policy agent or economic advisor can help buyers make strategies with area for changes to fulfill temporary and long-lasting monetary objectives.

Iul University

Some buyers might be shocked that it uses its life insurance plans to the general public. Still, military members delight in one-of-a-kind advantages. Your USAA policy comes with a Life Occasion Choice motorcyclist.

If your policy doesn't have a no-lapse warranty, you might even lose insurance coverage if your money value dips below a certain limit. It may not be a fantastic option for people that merely want a death benefit.

There's a handful of metrics whereby you can judge an insurer. The J.D. Power client satisfaction rating is a great alternative if you desire an idea of just how consumers like their insurance coverage. AM Ideal's monetary strength rating is an additional important statistics to take into consideration when choosing an universal life insurance policy business.

This is especially important, as your cash worth expands based on the financial investment options that an insurer supplies. You should see what financial investment alternatives your insurance carrier deals and contrast it against the objectives you have for your plan. The ideal way to discover life insurance policy is to accumulate quotes from as several life insurance policy business as you can to understand what you'll pay with each plan.

Latest Posts

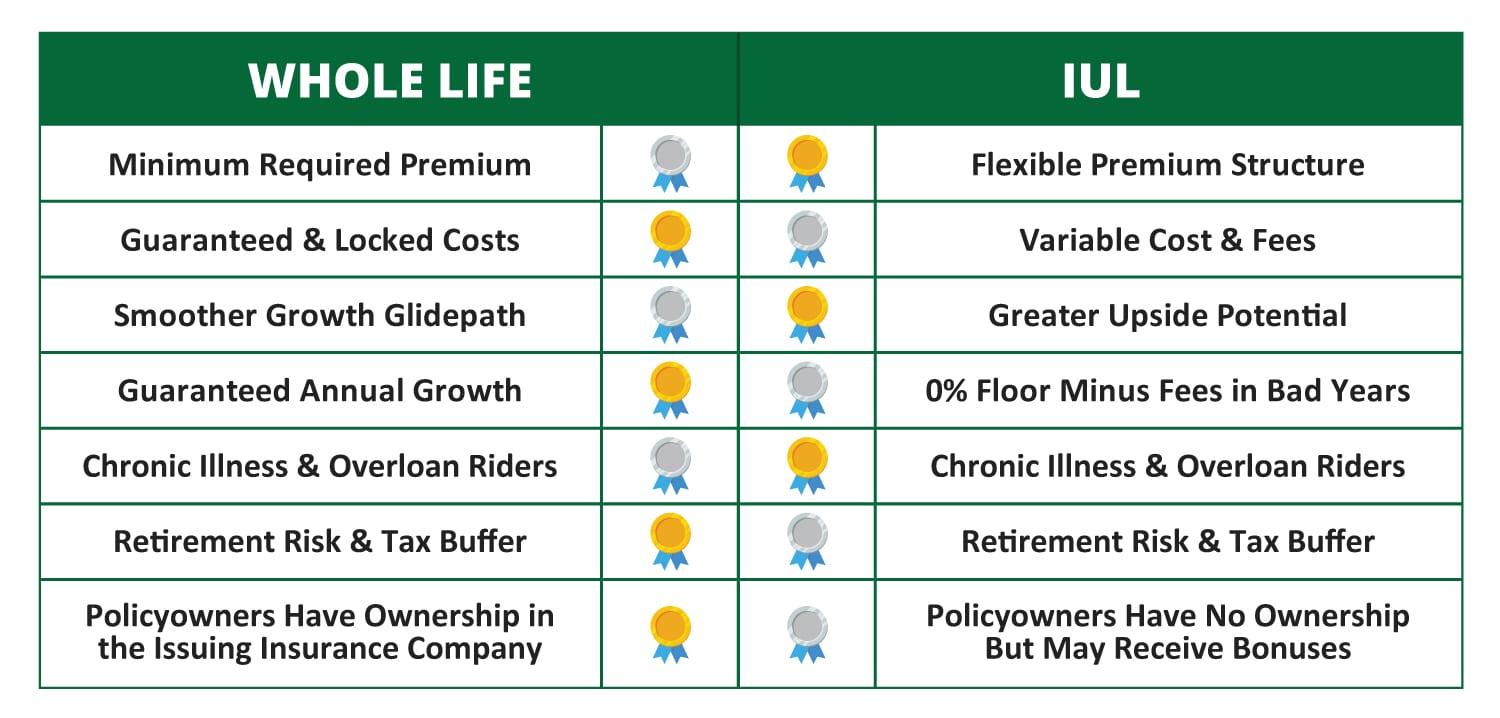

Indexed Universal Life Insurance Vs Whole Life Insurance

Financial Foundation Iul

Iul University